XRP Price Prediction: $4.80 in Sight as Technicals and News Align

#XRP

- Technical Breakout: MACD and Bollinger Bands signal bullish momentum above $3.15.

- Regulatory Catalyst: SEC settlement reduces uncertainty, fostering institutional interest.

- Stablecoin Expansion: Rail acquisition positions Ripple to disrupt the $120B stablecoin market.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

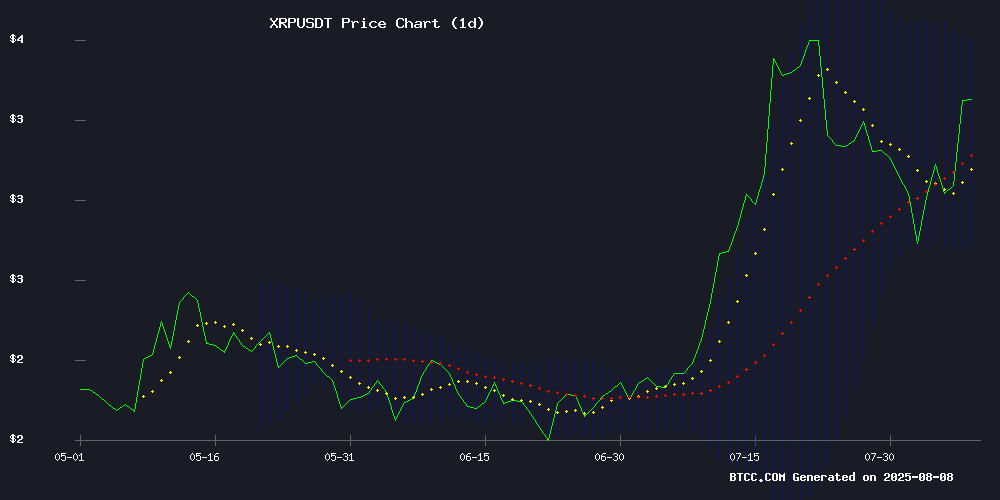

XRP is currently trading at $3.3018, above its 20-day moving average of $3.1563, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 0.0933, reinforcing upward momentum. Bollinger Bands suggest volatility, with the price NEAR the upper band at $3.5515, hinting at potential resistance. Analyst Emma from BTCC notes, 'The technical setup favors buyers, but a close above $3.55 could accelerate gains toward $4.'

XRP Market Sentiment: Legal Clarity and Institutional Adoption Fuel Optimism

Ripple's settlement with the SEC removes a key overhang, while Japan's ETF interest and South Korea's regulatory support add tailwinds. Emma highlights, 'The $200M Rail acquisition targets stablecoin infrastructure, potentially challenging USDC. News-driven demand could push XRP toward $4.80 if whale resistance at $3 breaks.'

Factors Influencing XRP’s Price

Ripple and SEC Reach Agreement to End Five-Year Legal Battle Over XRP

Ripple Labs and the U.S. Securities and Exchange Commission have moved to dismiss their long-running litigation, marking a watershed moment for cryptocurrency regulation. Court documents reveal an agreement-in-principle was reached, pending final SEC approval, to resolve claims that Ripple's XRP sales constituted unregistered securities offerings.

The settlement follows a pivotal 2023 district court ruling that determined XRP was not a security when sold on secondary markets. This partial victory for Ripple had been under appeal until both parties submitted a joint dismissal with signatures from Ripple executives Brad Garlinghouse and Christian Larsen alongside SEC attorneys.

With the appeals withdrawn, Ripple emerges free from federal litigation concerning XRP's regulatory status. The outcome sets a precedent that will likely influence how other digital assets are treated under U.S. securities law, arriving as Congress debates comprehensive crypto legislation.

XRP Eyes $4.80 Amid Japan ETF and South Korea Regulatory Support

XRP holds steady near $3 as the crypto market anticipates a pivotal SEC decision on Ripple's appeal withdrawal. A confirmation could propel the token past $3.30 resistance, with technical charts suggesting a potential rally toward $4.80. Neutral RSI and bullish MACD signals hint at breakout conditions if regulatory winds prove favorable.

Japan's SBI Holdings makes a landmark MOVE with its Bitcoin/XRP ETF filing, signaling institutional conviction. The Ripple stakeholder has committed to $1 billion in XRP purchases for treasury diversification. Meanwhile, South Korea's BDACS custodial approval grants XRP compliant access to Upbit and Coinone, cementing its position in Asia's crypto vanguard ahead of the country's 2025 spot ETF rollout.

Ripple Buys Rail, $200M Deal That Might Kill USDC’s Dominance

Ripple's $200 million acquisition of Rail signals a strategic shift in the digital payments landscape. The move could challenge USDC's market dominance, as Ripple leverages Rail's infrastructure to enhance cross-border transactions.

This deal underscores the intensifying competition among stablecoins and payment protocols. Market participants are watching closely to see if Ripple's play will disrupt the current equilibrium in crypto liquidity solutions.

XRP Price Projection: 5 Key Technical Signals to Monitor in Bull Market

XRP's price action shows volatile consolidation NEAR the $3.00 psychological level after July's rally to all-time highs. Chartist EGRAG CRYPTO identifies critical technical patterns shaping its trajectory.

Bullish 4-hour candle closes above $3.00 signal trader confidence, though upper wicks indicate persistent selling pressure. A retest of the $2.93-$2.96 support zone appears likely before continuation.

The token's ability to hold $2.90 demonstrates underlying strength despite broader market caution. Volatility across shorter timeframes suggests accumulation before the next decisive move.

Ripple Advances Stablecoin Infrastructure with Rail Acquisition as XRP Price Shows Resilience

XRP price demonstrates resilience, reclaiming the $3.00 support level and breaking out of a short-term descending channel amid a broader cryptocurrency market recovery. The asset surged to an intraday high of $3.08 before settling at $3.05, reflecting bullish sentiment.

Ripple's strategic $200 million acquisition of Rail, a stablecoin-powered payments platform, marks a significant step in bolstering its digital asset payments infrastructure. The integration of Rail with Ripple Payments aims to accelerate innovation in stablecoin adoption for global transactions.

Market interest in XRP remains tempered, with futures Open Interest down 34% from July peaks. Meanwhile, a pending WHITE House executive order could catalyze institutional adoption by permitting alternative assets like cryptocurrencies in US 401(k) retirement accounts.

Tug-of-War Near $3: Can XRP Buyers Overpower the Whale Wall?

XRP faces a critical juncture as whale activity and retail accumulation collide near the $3 price level. On-chain data reveals a sharp increase in whale inflows to exchanges, with the 30-day SMA of whale-to-exchange flows hitting 9,298 on August 7—the second-highest spike this year. Historically, such spikes precede price declines, as seen in January when XRP dropped from $3.27 to $1.70.

Retail buyers continue to accumulate, but their efforts may be overshadowed by whale selling pressure. The whale-to-exchange FLOW metric, which tracks large holders moving tokens to centralized platforms, suggests potential downside if retail demand fails to match the supply. The psychological $3 barrier remains a key battleground for XRP's near-term trajectory.

How High Will XRP Price Go?

XRP's trajectory depends on overcoming key levels:

| Level | Price (USDT) | Significance |

|---|---|---|

| Resistance | 3.5515 | Bollinger Upper Band |

| Target | 4.8000 | News-driven rally potential |

| Support | 3.1563 | 20-day MA |

Emma states, 'A sustained close above $3.55 may trigger FOMO buying, with $4.80 as the next psychological hurdle.'

3.5515

4.8000

3.1563